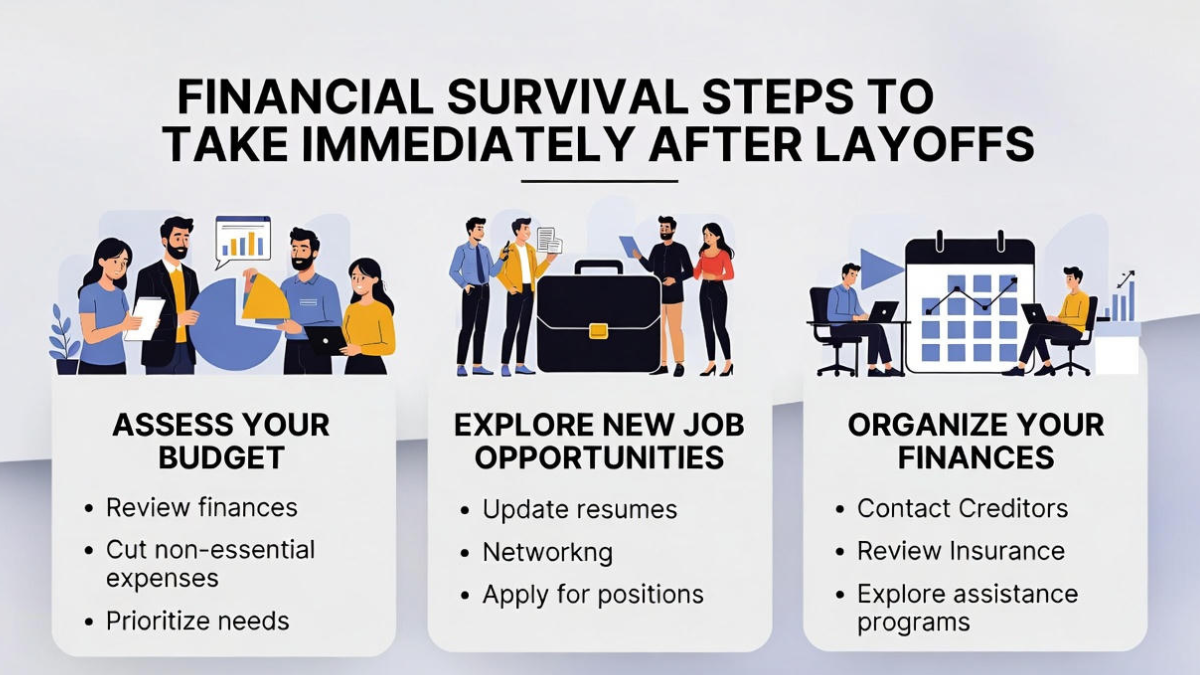

Job loss is one of the most emotionally and financially stressful experiences anyone can face, which is why Quick survival finance tips during layoffs have become critically important in today’s unstable job market. Layoffs often arrive without warning, leaving families struggling to manage income loss, rising expenses, debt obligations, and emotional pressure. The first few days after a layoff are crucial for financial stability.

Decisions taken during this phase directly determine how long your emergency fund will last, how well your expenses can be controlled, and how successfully you can handle critical negotiation situations with lenders, landlords, and service providers. By following practical Quick survival finance tips during layoffs, individuals can protect their financial foundation, reduce panic-driven mistakes, and create a controlled survival plan.

Understanding the First Financial Shock After a Layoff

The immediate financial impact after job loss creates a shock that often leads to fear-based decisions. One of the core purposes of Quick survival finance tips during layoffs is to slow down this panic and introduce clarity. Without proper planning, people often drain their emergency fund too fast or continue living at pre-layoff expenses levels, worsening the crisis.

The first financial risks include:

- Misjudging how long the emergency fund will last

- Continuing non-essential expenses

- Delaying negotiation with banks and landlords

- Relying blindly on credit cards

- Avoiding budget restructuring

The emotional pressure can disrupt rational thinking. This is why Quick survival finance tips during layoffs emphasize calm planning, immediate expense restructuring, and protective financial decision-making.

How to Stabilize Your Emergency Fund for Maximum Survival

Your emergency fund becomes your primary income source immediately after a layoff. One of the most critical Quick survival finance tips during layoffs is learning how to protect and stretch your emergency fund wisely. If managed correctly, this fund can buy you several months of stability while you search for new income.

Key emergency fund protection steps include:

- Calculating how many months your emergency fund can support you

- Separating essential and non-essential expenses

- Converting monthly survival into weekly budgets

- Suspending all discretionary spending

- Avoiding impulsive large withdrawals

Below is a simple table to help restructure your emergency fund usage after layoffs:

| Expense Type | Action Strategy | Fund Impact |

|---|---|---|

| Rent/Home loan | Prioritize immediately | High |

| Utilities | Minimize usage | Medium |

| Food | Shift to essential groceries | Medium |

| Subscriptions | Cancel immediately | Low |

| Entertainment | Eliminate temporarily | Low |

By controlling your expenses aggressively early on, your emergency fund lasts longer and reduces emotional pressure during job recovery.

Cutting Expenses Without Destroying Your Quality of Life

Expense reduction is one of the strongest pillars of Quick survival finance tips during layoffs. While panic cuts often feel extreme, intelligent expenses control focuses on sustainability rather than deprivation. The goal is not to suffer—but to survive longer with dignity.

Smart ways to control expenses include:

- Switching to home-cooked meals

- Downgrading mobile and internet plans

- Pausing streaming subscriptions

- Avoiding impulsive online shopping

- Using public transport when possible

Reducing expenses by even 20 to 30 percent dramatically increases the life of your emergency fund. These controlled adjustments protect long-term stability while preventing lifestyle shock.

The Power of Negotiation During Financial Crisis

One of the most overlooked Quick survival finance tips during layoffs is effective negotiation. Many people fear contacting banks, landlords, insurance providers, or creditors. But professional negotiation often leads to temporary relief without hurting long-term credit health.

Successful negotiation areas include:

- EMI payment deferral

- Credit card interest reduction

- Rent installment adjustments

- Utility payment extensions

- Insurance premium restructuring

Most institutions have official policies designed for temporary financial hardship. Through calm negotiation, you preserve cash, protect your emergency fund, and reduce monthly expenses significantly. Avoiding negotiation out of fear only accelerates financial collapse.

Psychological Finance Survival: Avoiding Fear-Based Money Decisions

The emotional trauma of layoffs often causes panic spending, emotional borrowing, and destructive financial behavior. A key objective of Quick survival finance tips during layoffs is to protect mental clarity alongside financial discipline. Fear-driven choices usually result in high-interest debt and rapid depletion of the emergency fund.

Emotional money traps to avoid:

- Taking payday loans

- Relying heavily on credit cards

- Selling long-term investments impulsively

- Withdrawing retirement funds prematurely

- Ignoring structured expenses control

Financial survival depends not only on numbers but also on emotional stability. Calm budgeting, structured negotiation, and controlled expenses form the psychological backbone of survival finance.

Creating a 30-Day Financial Survival Plan After Layoffs

A structured 30-day action plan is one of the most powerful Quick survival finance tips during layoffs. This plan acts as a bridge between unemployment shock and re-employment recovery.

A strong 30-day plan includes:

- Day 1–3: Expenses review and fund calculation

- Day 4–7: All creditor negotiation calls

- Week 2: Job search preparation and resume updates

- Week 3: Temporary income exploration

- Week 4: First budget performance review

This timeline keeps focus on action instead of fear. When people follow Quick survival finance tips during layoffs as a structured roadmap, confidence replaces panic.

Emergency Fund vs Borrowing: The Right Order of Survival

One of the biggest mistakes people make is borrowing before fully utilizing their emergency fund. Quick survival finance tips during layoffs clearly advise protecting your borrowing power for last-resort situations only.

Survival order of finance:

- First line: Emergency fund

- Second line: Controlled negotiation relief

- Third line: Family support if required

- Final line: Low-interest borrowing only

This hierarchy prevents debt traps and long-term financial damage that often extends beyond the layoff period.

Temporary Income Sources to Reduce Emergency Fund Drain

While searching for permanent employment, temporary income can significantly extend the life of your emergency fund. One of the strongest Quick survival finance tips during layoffs is to stabilize income flow even partially.

Temporary income sources may include:

- Freelance or consulting work

- Part-time retail or service jobs

- Online tutoring or skill-based gigs

- Selling unused household items

- Project-based remote work

Even small income streams reduce pressure on expenses and protect the long-term sustainability of your emergency fund.

Legal and Documentation Clean-Up After Layoffs

Beyond money, layoffs require administrative and legal attention. A hidden part of Quick survival finance tips during layoffs involves protecting legal and insurance rights.

Important actions include:

- Collecting severance documents

- Claiming unemployment benefits if applicable

- Transferring health insurance coverage

- Updating tax documentation

- Reviewing loan contracts before negotiation

These steps protect both current survival and future financial recovery.

Conclusion: Why Quick Survival Finance Tips During Layoffs Protect Your Future Stability

Experiencing a layoff is financially destabilizing—but it does not have to be financially destructive. By applying Quick survival finance tips during layoffs, individuals gain immediate control over their emergency fund, restructure expenses, and use strategic negotiation to protect cash flow. With discipline, calm planning, and structured decision-making, financial survival transforms into financial recovery. Job loss is temporary—but the financial habits built during this phase often shape long-term wealth and resilience.

FAQs

How long should my emergency fund ideally last after a layoff?

A well-managed emergency fund should support at least 3 to 6 months of essential expenses during unemployment.

What is the first financial action to take after losing a job?

The first step is to review your emergency fund and immediately restructure monthly expenses.

Is negotiation really effective with lenders after layoffs?

Yes, most banks and service providers offer relief options when proactive negotiation is initiated early.

Should I use credit cards during a layoff?

Credit cards should only be used for essential expenses and as a last resort after emergency fund planning.

Click here to learn more